Overview:

Prompted by the failure of the Bahamas-based FTX exchange in November 2022 — a platform that once stood among the world’s top five in cryptocurrency trading — calls for comprehensive cryptocurrency regulations have gained momentum. This event laid bare the inherent fragility and loopholes in the crypto landscape, worsened by unauthorized transactions and inadequate fund storage practices. FTX, which boasted over a million active users and a market valuation of USD 32 billion at the start of 2022, faced insolvency due to these irregularities.

In a significant move under India’s presidency, the G20 countries have collectively embraced the groundbreaking initiative to establish the world’s pioneering regulations governing cryptocurrencies. The new cryptocurrency framework is designed to bring cryptocurrencies within the ambit of legal and tax frameworks, allowing for monitoring of cryptoization and mitigation of illicit activities. The initiative aims to categorize cryptocurrencies as virtual digital assets and extend the regulatory scope to encompass various crypto tokens.

Contents

- How Cryptocurrencies work

- How Cryptocurrency Ecosystem is Structured

- Why a Stringent Policy Framework is Needed for Cryptocurrencies

- The Role of India, G20, IMF, and FSB in the New Framework

- The 5 Potential Makeovers that will Make Cryptocurrencies More Authoritative

- Summing Up

How Cryptocurrencies work:

Cryptocurrencies, as digital currencies, utilize encryption techniques for secure transactions. Their decentralized nature means no single entity has control over them. Created through a process called mining, cryptocurrencies are generated on a decentralized system that records transactions and issues new units. They operate across a network of computers using various AI algorithms, relying on the internet for functionality, and are independent of any central financial system or authority, not issued or backed by governments.

To engage with cryptocurrencies, one must possess a cryptocurrency wallet. Transactions involving cryptocurrencies usually occur on crypto exchanges. Unlike traditional currencies, cryptocurrencies have no intrinsic or legislated value; their worth is determined by market demand and what people are willing to pay for them.

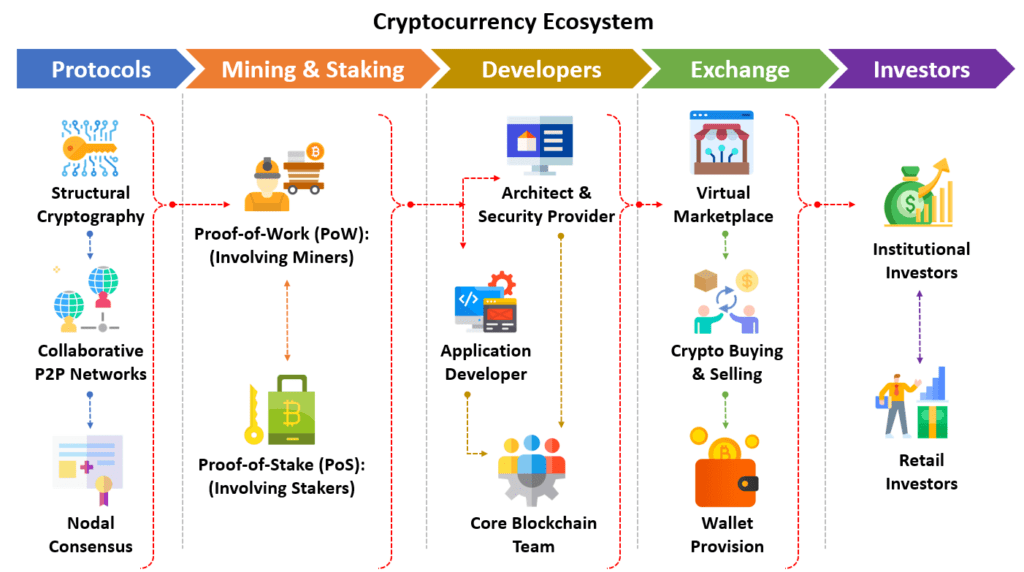

How Cryptocurrency Ecosystem is Structured:

Why a Stringent Policy Framework is Needed for Cryptocurrencies:

The recent failures of crypto-trading exchanges, along with instances of smaller and larger cryptocurrencies facing challenges, have underscored the inherent risks within the crypto-asset framework. These risks pose a significant threat to the stability of the financial ecosystem. In fact, they have the potential to permeate and impact the broader economy.

When these risks materialize and result in financial losses for investors in the crypto market, the ramifications extend beyond just the crypto sphere. The money lost through crypto investments is interconnected with and tied to the money circulating in the core of the national financial system. This interconnection amplifies the potential implications, highlighting how issues within the crypto landscape can reverberate throughout the entire economy.

The Role of India, G20, IMF, and FSB in the New Framework:

During the G20 summit in 2023, held under the Indian presidency, there was a notable push to accelerate the establishment of a comprehensive framework for regulating cryptocurrencies. India actively advocated for a globally accepted and standardized set of regulations governing the realm of cryptocurrencies. This proactive stance from India found widespread support among G20 member nations, as well as major international financial bodies such as the International Monetary Fund (IMF) and the Financial Stability Board (FSB), an entity tasked with monitoring and providing recommendations on the stability of the global financial system.

Under India’s leadership, the IMF and FSB collaborated to craft this regulatory framework. The framework was strategically designed to encompass stringent regulations aimed at allowing investors to leverage the potential benefits of crypto assets. Simultaneously, it addresses critical concerns related to security, consumer protection, financial stability, and the imperative of international collaboration within the realm of cryptocurrency. In essence, this framework seeks to strike a delicate balance between encouraging cryptocurrency’s potential and safeguarding the broader financial ecosystem.

The 5 Potential Makeovers that will Make Cryptocurrencies More Authoritative:

1. Extending the Utility of Crypto Token

The new crypto framework potentially holds the promise of empowering users with the capability to digitally sign documents by utilizing a crypto token. This significant feature is poised to enhance the security of digital interactions and provide robust support for the emerging paradigm of Web3. In practical terms, this implies that individuals and entities operating within the digital realm will have a reliable and secure means to authenticate and authorize various transactions, agreements, or engagements using the cryptographic tokens associated with cryptocurrencies. This not only elevates the level of security in digital interactions but also aligns with the principles and advancements propounded by the Web3 vision, which emphasizes a more decentralized, user-centric, and secure internet landscape.

2. Allocating the Status of Virtual Digital Assets (VDAs)

In its 2022 budget, India categorized cryptocurrencies as Virtual Digital Assets (VDAs) and introduced a comprehensive taxation framework encompassing activities like selling, swapping, or spending cryptocurrencies, irrespective of the transaction amount or frequency. Building on this regulatory approach, during its G20 presidency, India collaborated closely with the Financial Stability Board (FSB) and the International Monetary Fund (IMF) to validate and refine this plan. The overarching goal is to transform this localized framework into a globally recognized set of regulations governing crypto assets. By doing so, India aspires to establish a standardized and cohesive regulatory landscape for cryptocurrencies at an international level, enhancing clarity, security, and stability in the rapidly evolving domain of digital assets.

3. Putting Cryptocurrencies Under the Bracket of Taxation

The consensus among experts is that establishing a clear taxation framework for cryptocurrency transactions is pivotal for legitimizing them and placing them within the realm of responsible virtual currencies. India has already taken a significant step in this direction by implementing taxation on virtual currency, signaling an inclination towards formal recognition. In India’s Union Budget of 2022, the government unveiled a tax structure, imposing a 30% tax on gains from cryptocurrencies along with a 1% tax deducted at the source. The intent is for India to advocate for a harmonized global approach to such taxation, aiming for uniformity in regulations across nations concerning cryptocurrencies.

4. Monitoring for Cryptoization

Cryptoization, a theoretical concept, involves a shift where the citizens of a country start favoring cryptocurrency over their national currency. This phenomenon is especially relevant in nations grappling with economic instability and weak monetary systems. To curb potential risks associated with cryptoization, the new crypto regulation framework is designed to fortify regulatory measures. Its primary objectives include safeguarding client assets, managing risks related to conflicts of interest, and fostering international collaboration. This will be achieved by integrating policy insights derived from the IMF’s research on macroeconomic and monetary matters and the FSB’s work on supervisory and regulatory aspects.

5. Scrutinizing Money Laundering Involving Cryptocurrencies

The recently developed crypto regulation framework has a key focus on combating money laundering and illicit activities associated with digital currencies. Within this framework, stringent anti-money laundering obligations are imposed on crypto operators. They are mandated to register with the country’s central financial intelligence unit and proactively report any suspicious activities. India has already taken proactive steps in this direction and showing world a way, by establishing the Financial Intelligence Unit-India. This unit plays a pivotal role in receiving, processing, analyzing, and disseminating information related to potentially questionable financial transactions.

Summing Up:

The new policy framework holds the potential not only to align financial strategies within G20 nations but also to assist the global community in effectively managing highly influential virtual cryptocurrencies. It aims to establish a firm foundation in critical domains such as investor protection, cybersecurity, anti-money laundering, and counter-terrorism financing. This concerted and thorough policy approach toward crypto assets will promote coordination and collaboration on an international scale. While there’s a growing emphasis on a united policy response, several countries and jurisdictions have taken proactive steps in providing regulatory clarity on crypto assets. This mutual understanding among regulators, lawmakers, and industry stakeholders ensures a conducive environment for the growth and prosperity of Web3 and Virtual Digital Asset economies worldwide.

Excellent blog! Do you have any suggestions for aspiring writers?

I’m planning to start my own blog soon but I’m a little lost on everything.

Would you suggest starting with a free platform

like WordPress or go for a paid option? There are so many options out there that I’m completely overwhelmed ..

Any ideas? Appreciate it!

I read this piece of writing completely regarding the resemblance of latest and previous technologies, it’s amazing article.

I want to to thank you for this wonderful read!!

I definitely enjoyed every bit of it. I have you book

marked to look at new things you post…

Heya i’m for the first time here. I found this

board and I find It truly useful & it helped me out much.

I hope to give something back and help others like you aided me.

Genuinely no matter if someone doesn’t be aware of after that its up to other

viewers that they will assist, so here it occurs.