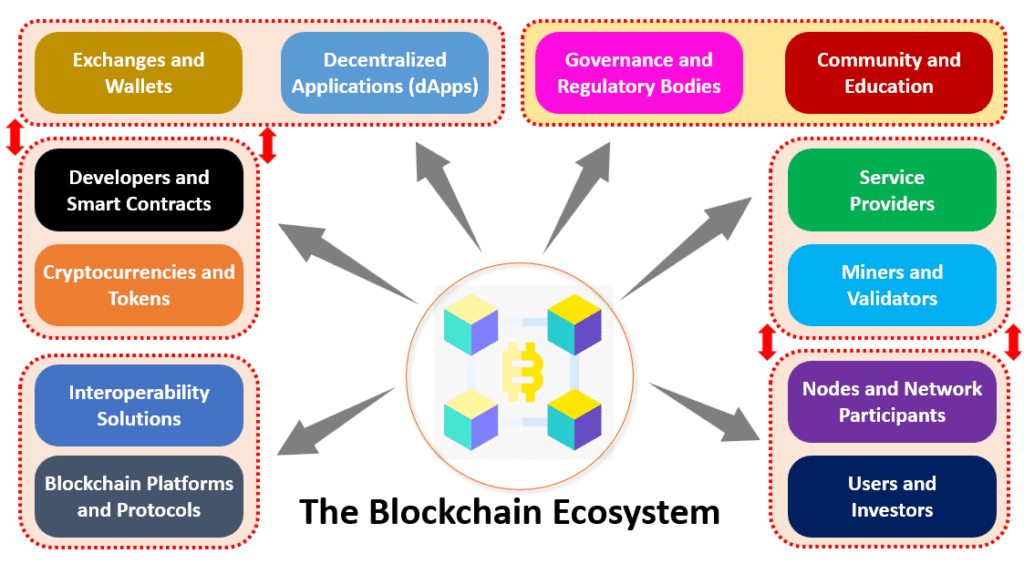

Overview:

This comprehensive overview provides detailed insights into each component of the blockchain ecosystem, illustrating how various platforms, technologies, and stakeholders interact to drive innovation and adoption in decentralized finance (DeFi), digital assets, and blockchain applications. From foundational protocols like Bitcoin and Ethereum to specialized platforms such as Hyperledger Fabric and Corda, blockchain technology has revolutionized industries by offering secure, transparent, and decentralized solutions.

Examples like Chainlink’s oracle network and Uniswap’s decentralized exchange highlight how specific projects and protocols are shaping the landscape of blockchain technology, enabling everything from automated financial transactions to the tokenization of digital assets. As blockchain continues to evolve, educational resources on platforms like Coursera and pioneering initiatives in interoperability solutions such as Polkadot and Cosmos underscore its potential to transform industries ranging from finance and supply chain management to healthcare and beyond.

So, let’s understand the Blockchain Ecosystem block-by-block:

1. Blockchain Platforms and Protocols:

1.A Public Blockchains:

Bitcoin (BTC): Launched in 2009 by Satoshi Nakamoto, Bitcoin operates as a decentralized peer-to-peer electronic cash system. It uses proof-of-work (PoW) consensus to validate transactions and secure the network. Bitcoin’s blockchain serves as a ledger for all transactions conducted using BTC.

Ethereum (ETH): Introduced in 2015 by Vitalik Buterin, Ethereum is a programmable blockchain platform enabling developers to build decentralized applications (dApps) and execute smart contracts. It utilizes a similar PoW consensus mechanism (transitioning to proof-of-stake) and has become the foundation for decentralized finance (DeFi) and non-fungible tokens (NFTs).

1.B Private Blockchains:

Hyperledger Fabric: Developed by the Linux Foundation, Fabric is a permissioned blockchain framework designed for enterprise use. It offers modular architecture, scalability, and support for private transactions tailored to specific business needs.

Corda: Created by R3, Corda is a permissioned blockchain platform focused on privacy and scalability for financial institutions. It allows businesses to transact directly and privately using smart contracts.

1.C Consortium Blockchains:

Quorum: Based on Ethereum, Quorum is designed for consortiums and enterprises needing high throughput and privacy. It supports private transactions and confidential contracts, making it suitable for financial applications.

Hyperledger Sawtooth: Another Linux Foundation project, Sawtooth features a modular architecture with a focus on scalability and permissioned networks. It supports pluggable consensus algorithms and is used in various industries for supply chain and healthcare applications.

2. Interoperability Solutions:

2.A Cross-Chain Protocols:

Polkadot: A multi-chain blockchain platform that enables interoperability between different blockchains. Polkadot uses a relay chain and parachains architecture, allowing independent blockchains to share information and assets securely. It facilitates scalable and customizable blockchain networks suitable for various use cases, including decentralized finance (DeFi) and enterprise applications.

Cosmos: A decentralized network of independent blockchains interoperating through the Inter-Blockchain Communication (IBC) protocol. Cosmos enables blockchain projects to connect, communicate, and transfer assets across different chains, enhancing scalability and interoperability in the blockchain ecosystem.

2.B Bridge Protocols:

Wormhole: A bridge protocol between Ethereum and Solana blockchains, allowing tokens and data to move across both networks securely and efficiently. Wormhole facilitates decentralized finance (DeFi) applications and cross-chain transactions.

Binance Smart Chain Bridge: Enables assets to be transferred between Binance Smart Chain (BSC) and Ethereum, leveraging a bridge mechanism to maintain liquidity and facilitate cross-chain DeFi activities.

3. Cryptocurrencies and Tokens:

3.A Native Cryptocurrencies:

Bitcoin (BTC): As the first cryptocurrency, BTC is primarily used as a store of value and medium of exchange. Its limited supply (21 million coins) and decentralized nature contribute to its value proposition as digital gold.

Ethereum (ETH): Used as gas fees for transactions and computational services on the Ethereum network, ETH powers the ecosystem of decentralized applications and smart contracts.

3.B Tokens:

ERC-20 Tokens: Tokens built on the Ethereum blockchain following the ERC-20 standard. These tokens are fungible and can represent various assets, from stablecoins like USDT (Tether) to utility tokens like LINK (Chainlink).

Non-Fungible Tokens (NFTs): Unique digital assets on blockchains like Ethereum, representing ownership or proof of authenticity of digital content such as art, collectibles, and virtual real estate. Examples include CryptoKitties, NBA Top Shot moments, and digital art sold on platforms like OpenSea.

4. Developers and Smart Contracts:

4.A Developers:

Solidity Developers: Specialize in writing smart contracts for Ethereum using Solidity, Ethereum’s native programming language. They create decentralized applications (dApps) and deploy smart contracts that govern transactions and interactions within the Ethereum ecosystem.

Rust Developers: Work on blockchains like Polkadot and Solana, using Rust for smart contract development and building scalable blockchain solutions.

4.B Smart Contracts:

Ethereum Smart Contracts: Self-executing contracts with predefined rules written in code on the Ethereum blockchain. They automate processes like token issuance (e.g., ERC-20 tokens), decentralized exchanges (DEXs), lending protocols (e.g., Compound, Aave), and yield farming strategies.

Cardano Smart Contracts: Written in Plutus, Cardano’s native language, enabling complex financial transactions, decentralized applications, and automated governance mechanisms.

5. Exchanges and Wallets:

5.A Exchanges:

Coinbase: A leading cryptocurrency exchange in the United States, offering a platform for buying, selling, and trading a variety of cryptocurrencies, including Bitcoin and Ethereum. Coinbase provides user-friendly features and high liquidity.

Binance: One of the largest global cryptocurrency exchanges, offering a wide range of cryptocurrencies and trading pairs. Binance supports advanced trading features, futures contracts, and a decentralized exchange (Binance DEX).

5.B Wallets:

MetaMask: A popular Ethereum wallet and browser extension allowing users to interact with Ethereum dApps directly from their browser. MetaMask supports ETH and ERC-20 tokens, offering secure storage and easy management of digital assets.

Ledger Nano S: A hardware wallet providing cold storage for cryptocurrencies, protecting private keys offline. Ledger wallets support multiple cryptocurrencies and offer enhanced security features against hacking and malware attacks.

6. Decentralized Applications (dApps):

6.A DeFi Platforms:

Uniswap: A decentralized exchange (DEX) facilitating automated token swaps on the Ethereum blockchain. It uses liquidity pools and smart contracts to enable permissionless trading without intermediaries.

Compound: A decentralized lending protocol allowing users to earn interest on deposited cryptocurrencies or borrow assets by collateralizing other cryptocurrencies. It operates autonomously through smart contracts, determining interest rates based on supply and demand.

6.B NFT Marketplaces:

OpenSea: The largest NFT marketplace, supporting the buying, selling, and trading of digital assets like art, collectibles, and virtual real estate. OpenSea provides tools for creators to mint NFTs and manage their digital collections.

Rarible: A decentralized platform where creators can mint, buy, sell, and collect NFTs. Rarible emphasizes community governance and creator royalties, empowering artists and collectors in the NFT ecosystem.

7. Governance and Regulatory Bodies:

7.A Governance Models:

On-Chain Governance: Implemented by blockchain projects like Tezos and Decred, allowing token holders to vote on proposals and protocol upgrades directly on the blockchain. It promotes transparency and community involvement in decision-making.

Off-Chain Governance: Utilized by Bitcoin and Ethereum communities through forums, developer meetings, and social media to propose and discuss changes before consensus among miners or validators.

7.B Regulatory Bodies:

SEC (Securities and Exchange Commission): U.S. regulatory agency overseeing securities laws, including how they apply to cryptocurrencies, ICOs, and token offerings. It aims to protect investors and maintain fair, orderly, and efficient markets.

FATF (Financial Action Task Force): Sets international standards for combating money laundering and terrorist financing. FATF guidelines influence how cryptocurrencies and blockchain-based financial services are regulated globally to ensure compliance with AML (Anti-Money Laundering) and CFT (Counter Financing of Terrorism) requirements.

8. Community and Education:

8.A Communities:

Bitcoin Talk Forum: An influential forum for discussing Bitcoin and cryptocurrency-related topics, including technical developments, market trends, and regulatory issues. It serves as a knowledge-sharing platform for developers, miners, traders, and enthusiasts worldwide.

Reddit: Subreddits like r/cryptocurrency and r/ethereum serve as vibrant communities where users discuss news, share insights, and engage in debates about blockchain technology, cryptocurrencies, and decentralized applications (dApps).

8.B Educational Resources:

Coursera and Udemy: Offer online courses covering blockchain fundamentals, cryptocurrency trading, smart contract development, and blockchain technology applications. These platforms provide accessible learning materials for beginners and advanced learners interested in blockchain technology.

Mastering Bitcoin by Andreas M. Antonopoulos: A comprehensive book that explores the technical aspects, economic implications, and societal impact of Bitcoin and blockchain technology. It serves as a valuable resource for understanding the underlying principles of decentralized systems and cryptographic protocols.

9. Service Providers:

9.A Oracles:

Chainlink: A decentralized oracle network connecting smart contracts with real-world data, enabling applications to interact with external sources reliably and securely. Chainlink’s decentralized approach ensures data accuracy and tamper resistance. For example, decentralized finance (DeFi) platforms use Chainlink to fetch price feeds for assets and execute financial transactions based on accurate market data.

Band Protocol: Another decentralized oracle platform providing data feeds to blockchain applications. Band Protocol uses a delegated proof-of-stake (dPoS) consensus mechanism where validators secure and verify data, ensuring reliable information for smart contracts and decentralized applications.

9.B Consultancies and Development Firms:

Consensys: A leading blockchain technology firm offering development tools, consulting services, and enterprise solutions primarily focused on Ethereum. Consensys supports the development of decentralized applications (dApps), token issuance, and blockchain integration for businesses and governments.

Altoros: Provides blockchain consulting, development, and integration services across various blockchain platforms. Altoros assists enterprises in adopting blockchain technology for supply chain management, healthcare, finance, and IoT (Internet of Things) applications, ensuring scalability and interoperability.

10. Miners and Validators:

10.A Miners:

Bitcoin Miners: Use computational power to solve complex mathematical problems (proof-of-work) and validate transactions on the Bitcoin blockchain. They compete to add new blocks to the chain and earn block rewards (BTC).

Ethereum Miners: Initially used GPUs and later ASICs to validate transactions and add blocks to the Ethereum blockchain. Ethereum is transitioning to proof-of-stake (PoS) with validators replacing miners in securing and validating transactions.

10.B Validators:

Ethereum 2.0 Validators: Stake ETH to secure the network and validate transactions in the new PoS consensus mechanism. Validators propose and attest to new blocks, earning rewards based on their stake and participation in network security.

11. Nodes and Network Participants:

11.A Full Nodes:

Bitcoin Full Nodes: Maintain a complete copy of the Bitcoin blockchain and validate all transactions according to consensus rules. They play a crucial role in decentralization, ensuring the integrity and security of the network.

Ethereum Full Nodes: Store the entire Ethereum blockchain and enforce consensus rules. Full nodes relay transactions and blocks, supporting network stability and resilience.

11.B Light Nodes:

Bitcoin SPV (Simplified Payment Verification) Nodes: Lightweight clients that don’t store the entire blockchain. They verify transactions by querying full nodes, offering reduced storage requirements suitable for mobile wallets.

Ethereum Light Clients: Sync with the Ethereum blockchain by querying full nodes, enabling users to interact with dApps and manage their assets without downloading the full blockchain.

12. Users and Investors:

12.A End-Users:

DeFi Participants: Users leveraging decentralized finance protocols for lending, borrowing, trading, and earning yields without intermediaries. Examples include liquidity providers on Uniswap, borrowers on Compound, and yield farmers optimizing returns across DeFi platforms.

NFT Collectors: Individuals buying, selling, and trading non-fungible tokens (NFTs) representing digital art, collectibles, and virtual real estate. Marketplaces like OpenSea and Rarible facilitate NFT transactions and ownership verification.

12.B Investors:

Retail Investors: Individuals investing in cryptocurrencies through exchanges for long-term holding, speculative trading, or participating in initial coin offerings (ICOs) and token sales.

Institutional Investors: Entities like hedge funds, asset managers, and corporations allocating capital to cryptocurrencies as a store of value, hedge against inflation, or portfolio diversification strategy.

Summing Up:

The blockchain ecosystem stands as a testament to the transformative power of decentralized technologies. By fostering innovation through platforms like Ethereum and advancements in interoperability such as Polkadot and Cosmos, blockchain has not only revolutionized finance but has also extended its impact across various sectors. From enhancing transparency in supply chains to enabling new forms of digital ownership through NFTs, blockchain continues to reshape traditional paradigms.

As stakeholders from developers to institutional investors embrace its potential, coupled with ongoing educational efforts and regulatory advancements, the blockchain landscape is poised for continued growth and adoption. With each advancement and collaboration, the promise of a decentralized future becomes increasingly tangible, offering new opportunities and efficiencies for global industries and economies alike.

One thought on “Decoding the Blockchain Ecosystem from Protocols to Innovation”