Overview:

This comprehensive article delves into the details of electric vehicles (EVs), encompassing fundamental concepts, diverse types, operational procedures, the broader ecosystem, market dynamics, drivers, barriers, government actions, as well as strategic investments and developments across the world.

In the current age of sustainability, the shift from unsustainable solutions to viable alternatives is evident, driven by the imperative to fulfill present and future needs. Notably, electric vehicles stand out as a transformative force poised to reshape 21st-century transportation.

Although the roots of electric vehicles trace back to the 1820s, it wasn’t until the 1890s that they gained commercial viability. However, factors like higher production costs, limited top speeds, and inefficiencies in battery technology hindered their popularity compared to internal combustion engine vehicles. These ICE vehicles gained prominence in the automotive industry’s research and development landscape during the 1900s.

Fast forward around a century, mounting pollution concerns and greenhouse gas emissions compelled the automotive sector to earnestly pursue more efficient electric vehicles. This pursuit was bolstered by synergistic technologies such as carbon-neutral energy sources, advanced high-capacity batteries, and governmental initiatives. Consequently, this evolution extended electric vehicles’ domain from railways to the realm of road transportation.

Contents:

- What is Electric Vehicle

- A Typical Electric Vehicle Ecosystem

- Types of Electric Vehicles

- Application Areas of Electric Vehicles

- Major Driving Forces Helping Electric Vehicle Adoption

- Key Barriers Restricting Electric Vehicle Adoption

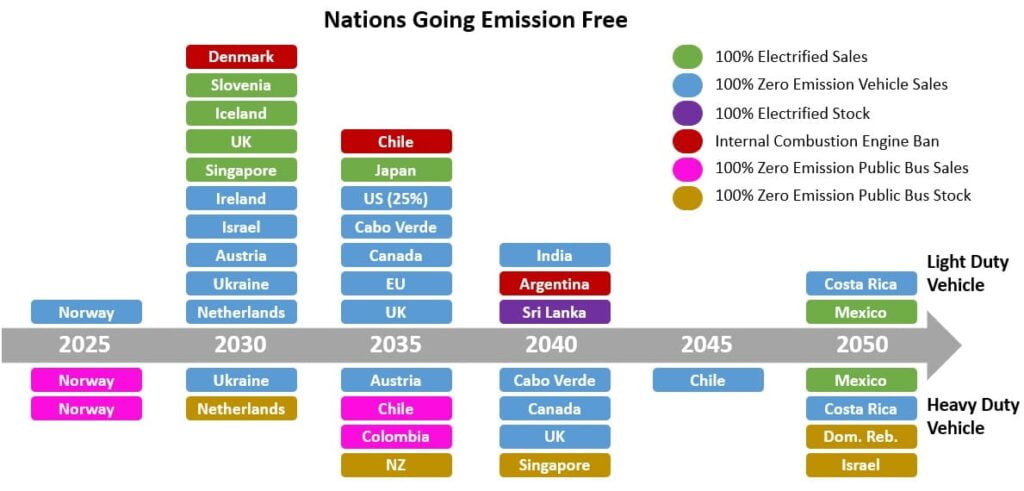

- Nations Going Emission Free from Vehicles

- Major Initiatives Taken for Electric Vehicles by the Top-5 Economies

- Key Developments Happened Around Electric Vehicles in the Top-5 Economies

What is Electric Vehicle:

An electric vehicle (EV) presents a sustainable mode of transportation that generates no greenhouse gas emissions during operation. This is achieved by employing an electric motor in lieu of an internal combustion engine for propulsion. The electric motor draws power from a collector system, typically linked to an energy source known as a traction pack, which is commonly a rechargeable battery. Charging these batteries is feasible through a current source.

Notably, electric vehicles exhibit reduced operational and maintenance expenses due to their simplified mechanical components. In earlier iterations of EVs, lead-acid or nickel-metal hydride batteries were utilized. However, contemporary EVs predominantly rely on lithium-ion batteries, renowned for their energy retention longevity.

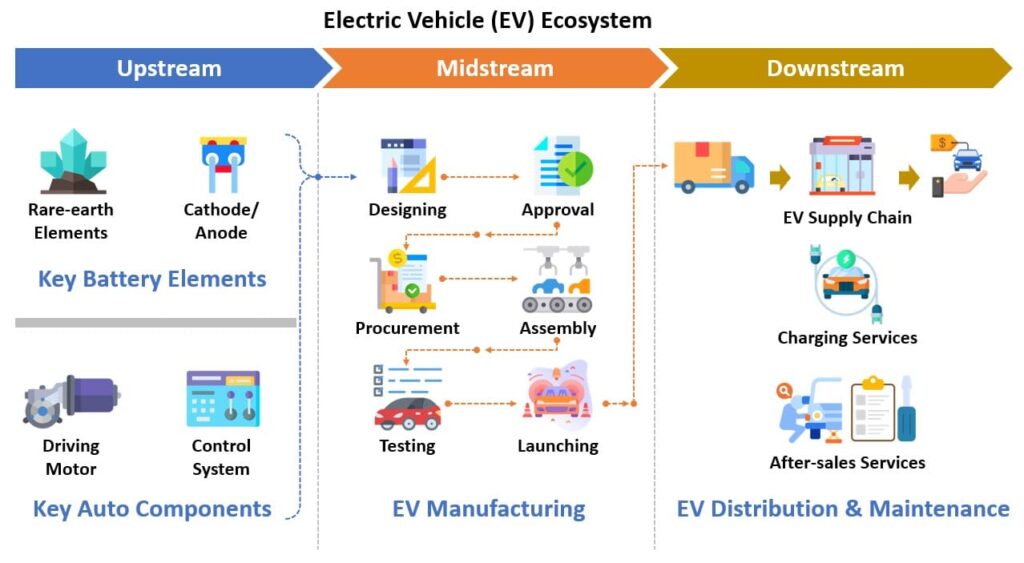

A Typical Electric Vehicle Ecosystem:

Types of Electric Vehicles:

Categorized according to advancements, electric vehicles are primarily divided into four distinct types.

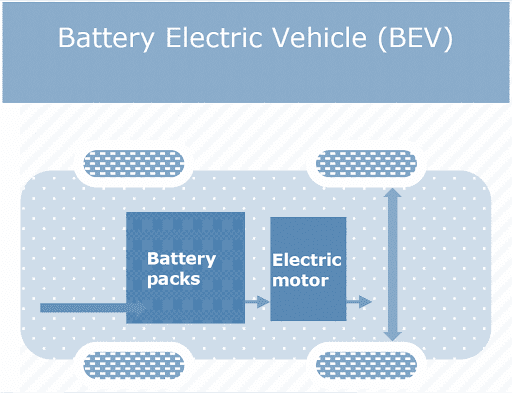

1. BEV (Battery Electric Vehicle)

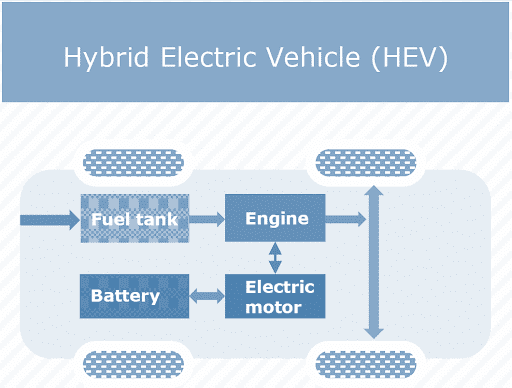

2. HEV (Hybrid Electric Vehicle)

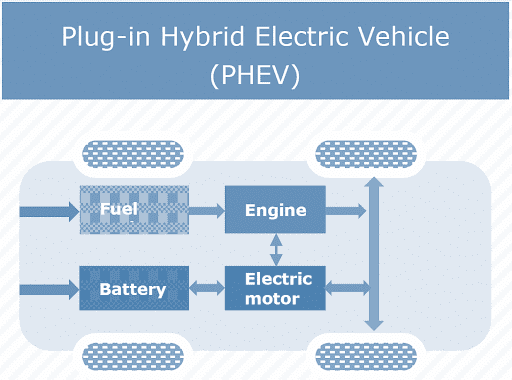

3. PHEV (Plug-in Hybrid Electric Vehicle)

4. FCEV (Fuel Cell Electric Vehicle)

Let’s take a deep dive into the above variants to understand them a bit more

PIC Source: GOI

| Particulars | BEV | HEV | PHEV | FCEV |

| Propulsion Power Source | Exclusively powered by batteries, devoid of any internal combustion engine (ICE) components | Powered by both batteries and internal combustion engine (ICE) components | Resembling HEVs but equipped with a larger battery pack for vehicle propulsion and the added capability of charging | Utilizing a fuel cell, which generates electricity via chemical reactions, in combination with a battery pack to provide continuous power without recharging |

| Efficiency | Most efficient among all EVs | Less efficient than BEV | Considered better than HEV, but less efficient as BEVs | Most complex propulsion system, efficient as BEVs |

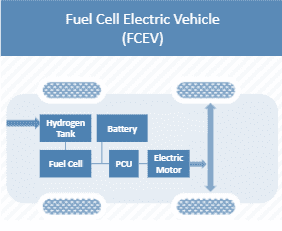

| Key Components | Battery pack, Electric motors, Inverter, Control module, Drive train, and Charge port | Internal combustion engine, Battery pack, Electric motors, Control module, Inverter, Drive train, Fuel tank, and Charge port | Internal combustion engine, Battery pack, Electric motors, Control module, Inverter, Drive train, Fuel tank, Charge port, and Exhaust system | Battery pack, Electric motors, Inverter, Control module, Drive train, Fuel cell stack, and Fuel tank |

| Work Mechanism | The battery pack transmits power to electric motors, propelling the vehicle’s wheels. When braking or decelerating, the motor functions as an alternator, generating power to recharge the battery pack | The wheels are primarily driven by an internal combustion engine (ICE), while the batteries undergo charging during braking and deceleration. Subsequently, these charged batteries supply power to car systems such as the AC or steering, ultimately enhancing the car’s fuel efficiency and delivering improved mileage | Similar to HEVs, but featuring a more potent motor connected to battery packs. These packs are charged via external power sources. The charged batteries supply energy to the electric motor, propelling the wheels and extending the range. Power transmission adjustments are made based on terrain requirements | The vehicle operates on hydrogen fuel, which is transformed into electricity via a fuel cell, subsequently charging the battery. The battery pack then drives the motors to propel the vehicle and fulfill all of its electricity demands |

Application Areas of Electric Vehicles

The expansion of the EV market has broadened its scope beyond roadways and railways, now encompassing surface and underwater vessels, as well as aircraft. Within roadways, EVs are synergistically supported by emerging automotive technologies like autonomous driving, AI (ChatGPT), connected vehicles, and shared mobility. Let’s delve into these potential application areas:

Individual Transport (Two-wheelers, Bikes):

An electric bike, or E-bike, refers to a battery-powered motorized bicycle that operates without the need for a combustion engine. E-bikes have become a favored mode of transportation for many individuals due to their versatility in navigating various terrains and their enhanced efficiency in handling slopes.

According to a recent report, the global electric bike market, valued at USD 65 billion in 2022, is projected to experience a Compound Annual Growth Rate (CAGR) of 9% from 2023 to 2032. This growth trajectory is expected to lead to a market value of USD 153.8 billion by 2032. In 2022, the Asia Pacific region accounted for 42% of the market share. The primary driver behind this expansion is the international surge in fossil fuel prices, prompting the widespread adoption of electric bikes across various markets.

Individual Transport (Four-wheelers, Cars):

This field stands as the most prominent application segment for electric vehicles. The widespread adoption of electric cars, often interchangeably referred to as electric vehicles (EVs), has seamlessly integrated them into the common dialect. Similar to traditional non-electric cars, which have long served as a need in family transportation, electric cars have steadily gained prominence within households over recent years. Fueled by their intracity transportable capabilities, they have contributed significantly to the reduction of greenhouse gas emissions on roadways.

In accordance with a report, the electric car market is experiencing exponential growth, with sales surpassing the 10 million marks in 2022, and a projection to cross the 14 million milestone in 2023. Notably, electric cars accounted for 14% of all new car sales in 2022, a notable increase from around 9% in 2021 and less than 5% in 2020. China notably led the market, contributing to approximately 60% of the share, while the United States held a comparatively smaller 8% share.

Public Transport (Electric Buses):

While private vehicle owners have diverse preferences, a substantial number of travelers opt for public transportation. Particularly dominant within urban settings, electric buses have emerged as a favored mode of transport. They excel in city commutes and, depending on their load-to-size ratio, electric buses are especially suited for intracity connections, capably accommodating up to 30 passengers per trip.

According to a report, the global electric bus market reached a valuation of USD 28.3 billion in 2022 and is projected to maintain an impressive CAGR of 20.4% from 2023 to 2030. The Asia Pacific region notably held the lion’s share of the electric bus industry in 2022, accounting for over 80% of the market. This dominance can be attributed to the escalating demand for eco-friendly transportation solutions in countries like China, India, and Japan. As of March 2022, China boasted a fleet of over 421,000 operational electric buses, constituting nearly 99% of the global total.

Logistics and Supply Chain (Electric Trucks):

Typically driven by electric trucks powered by heavy-duty batteries designed for cargo transportation and specialized payloads. Although the battery’s size and weight render it less suitable for longer and heavier freight, it has proven effective for shorter intracity applications, serving as a viable logistics solution that aligns seamlessly with urban planning requirements and municipal regulations. Moreover, while these trucks were previously reliant on lead-acid batteries, advancements have led to the use of lighter and more energy-dense battery technologies.

According to a report, the electric truck market, in terms of value, is projected to encompass 101,499 units in 2022, and this figure is anticipated to surge to 1,067,985 units by 2030, reflecting an impressive CAGR of approximately 34%. Key players in this sector include China’s BYD, Germany’s Mercedes-Benz, Sweden’s Volvo, and U.S. companies like Ford and Vivian.

Rail-borne Transport (Power Trains):

Trains operate on fixed tracks, which lends them to the advantage of being easily powered through electric lines, typically achieved via permanent overhead lines. This eliminates the necessity for bulky onboard batteries. As a result of this fixed track infrastructure, railways have emerged as a highly suitable candidate for electrification, effectively transitioning rail-borne vehicles into electric variants. Prominent examples encompass electric locomotives, electric trams, electric light rail systems, and electric rapid transit systems. The absence of hefty internal combustion engines or large batteries contributes to favorable power-to-weight ratios, enabling these systems to achieve speeds exceeding 300 km/h effortlessly.

According to a report, the Electric Vehicle Power Train market garnered a valuation of USD 128.1 billion in 2022, and it is projected to experience a CAGR of 33.5% from 2023 to 2029, ultimately reaching a market value of USD 967.8 billion by 2029.

Air-borne Transport (Electric Aircrafts):

Airborne flight demands significant power, which is why conventional airplanes rely on specialized jet fuels to fuel their combustion engines, achieving higher power outputs per gallon. As a result of this substantial power requirement, electric aircraft have found their primary application in unmanned aerial vehicles. Although there have been multiple attempts to develop manned electric aircraft, the level of success achieved thus far has been relatively limited.

According to an insightful report, the Electric Aircraft Market is projected to exceed USD 29.8 billion by 2028, fueled by a CAGR of 15.4% during the period from 2022 to 2028. This growth trajectory is largely attributed to advancements in electric motor technology, battery innovations, and power electronics.

Sea-borne Transport (Electric Ships):

Electric ships and boats enjoyed popularity earlier in the 20th century. However, the emergence of diesel-powered ships, offering enhanced top speeds and improved control capabilities, led to their displacement. In recent times, renewed interest in electric ships and boats has ushered in options such as solar-driven ships, including sailboats with potentially infinite ranges. Furthermore, contemporary developments encompass electric ferries and submarines propelled by batteries. These batteries are charged by diesel or gasoline engines at the surface, nuclear-powered fuel cells, or Stirling engines, all of which contribute to driving electric motor-propelled propellers.

According to a report, the global electric ship market is poised to witness substantial growth, surging from USD 3.8 billion in 2023 to USD 12.8 billion by 2030, showcasing a robust CAGR growth of 18.9% over the given period.

Major Driving Forces Helping Electric Vehicle Adoption:

Favorable Government Policies:

Governments around the world are taking steps to phase out vehicles that contribute to higher pollution levels. Escalating gasoline prices and their fluctuation have spurred these governments to gear up for electric vehicle (EV) integration. Leading markets like the US, China, and Europe have played a pivotal role in driving demand and supply through enticing incentives for manufacturers and buyers alike. These markets are additionally bolstering the EV supply chain by introducing favorable policies aimed at nurturing battery manufacturing. The momentum for EV adoption is global, with countries such as India and various Southeast Asian nations, including Singapore, solidifying their EV adoption strategies in recent times.

An estimation reveals that governments across the globe have significantly escalated their investments in EVs, with expenditures surpassing USD 400 billion in 2022. Moreover, during the same year, policy incentives that promote EV uptake covered over 90% of global sales for Light Duty Vehicles. In a parallel trend, approximately 70% of global Heavy Duty Vehicle sales in 2022 were also encompassed by favorable EV policies.

Public Charging Infrastructure Availability:

While electric vehicles (EVs) can conveniently be charged at home, longer journeys necessitate publicly accessible charging stations along roadways. This infrastructure requirement has become a paramount necessity and is currently undergoing a significant transformation, with numerous charging stations being deployed, primarily in developed and major developing countries. The objective is to establish robust charging networks that cater to the evolving needs of EV users. The EV charging infrastructure holds a pivotal role in the industry’s transformation from internal combustion engines to cleaner electric motors, acting as its backbone. Notably, prominent EV manufacturers like Ford Motor Group, Volkswagen Group, Mercedes-Benz AG, Hyundai Motor Group, and BMW Group have proactively partnered to establish extensive networks of EV charging infrastructure.

As of 2021, China leads the global count of publicly available fast charging points with a substantial 470,000 installations. Following suit are the United States with 21,750 installations, South Korea with 15,070 installations, Germany with 9,160 installations, Japan with 8,040 installations, and the United Kingdom with 7,660 installations.

Growing Demand for 360-degree Infotainment System in Vehicle

Due to the absence of bulky combustion engines in electric vehicles (EVs), these vehicles often boast a surplus of available interior space. This surplus has paved the way for enhanced and improved versions of infotainment systems within EVs. As a result, the realm of in-car media entertainment and connectivity has evolved into a key differentiating factor, particularly among battery-powered EVs. A significant number of high-end EV models now cater to tech-savvy consumers, offering advanced infotainment features. Conversely, lower-tier EVs typically focus on facilitating smartphone and tablet connections, as well as basic online services.

Notably, electric vehicles have emerged as the primary platform for self-driving vehicle technology. This is primarily due to their superior connectivity options, simplified starting and stopping mechanisms, and spacious interactive dashboards, all of which contribute to an enhanced user experience during periods of self-driving.

Innovation in EV Battery Technology:

From heavy lead-acid batteries with limited range to nickel-metal hydride batteries, the EV industry transformed with the arrival of lithium-ion batteries in the early 2000s. Lithium-ion batteries offered compactness, lighter weight, and higher energy density, enabling longer ranges and faster charging. Ongoing R&D focuses on cost reduction and enhanced energy density for extended ranges.

Lithium-sulfur batteries, a recent innovation, offer higher energy density, cost-effectiveness, and use sustainable materials. They can even replace graphite anodes with silicon, potentially boosting energy density further.

Regarding recycling and repurposing, the EV industry is in its infancy, yet actively researching 100% lithium recovery from used batteries. Efficient recycling can cut waste and environmental impact. Notable players like Tesla are working on efficient recycling methods, acknowledging that retired EV batteries still hold significant energy potential.

Key Barriers Restricting Electric Vehicle Adoption:

Claimed Range of EVs:

One of the pivotal factors influencing the decision to purchase an electric vehicle (EV) is its range. However, this aspect often falls short, leading to partial or even false promises. According to a report, many fully battery-operated vehicles fail to deliver on their long-term cost savings and range commitments.

The report indicates that internal combustion engines (ICEs) outperform their rated fuel efficiency by 4%. Additionally, 66% of all ICEs exceed their labeled miles per gallon figures. Conversely, EVs on average underperform their rated range by 12.5%, with only 17% of all EVs managing to surpass their range estimates. EVs also exhibit an adjustment factor of 0.7 or higher, implying their range is approximately 30% lower than calculated.

Cost of Batteries:

The production of EV batteries relies on a spectrum of rare earth elements, aside from lithium. Other promising elements for EV batteries include nickel, cobalt, manganese, and graphite. Many of these elements are challenging to extract and exist in limited supply. The availability of these elements crucially facilitates the manufacturing of EV batteries, which in turn simplifies EV production. However, scarcity or easy availability of these elements significantly affects battery costs, thereby elevating the overall cost of EVs. The battery stands as one of the most pivotal components in an EV, accounting for 40% of the vehicle’s total price.

Nations such as China, the US, Germany, Japan, Poland, and Hungary are major global suppliers of EV batteries, exerting substantial influence over pricing for an extended period. This dynamic has repercussions for other sourcing countries, like India, which heavily relies on battery cell imports from China, Japan, and South Korea, contributing to higher EV manufacturing costs in India. This challenge extends beyond India, affecting numerous countries worldwide, ultimately driving up the cost of EVs to a point of potential unaffordability.

Impact on Environment:

The ecological impact of EVs often remains overlooked or misunderstood by most end users. Many EV battery manufacturers source rare earth elements from deep within the Earth’s rock beds, resulting in extensive excavation for relatively small quantities. Additionally, the production of EV batteries demands substantial energy and raw materials, potentially leading to significant greenhouse gas emissions. Another challenge arises from the proper disposal of EV batteries at the end of their lifecycle, as improper recycling could further harm the environment.

Developing environmentally friendly EV batteries that are fully recyclable remains an ongoing area of research and development. It is imperative for both researchers and manufacturers to focus on the creation of more sustainable and eco-friendly battery technologies to mitigate these ecological impacts.

Charging time:

The average charging duration for EVs, from zero to full, typically ranges from 6 to 8 hours when utilizing a standard 7kWh fast charger, commonly found at public long-stay areas, supermarkets, or on-street charging stations. However, the utilization of rapid chargers significantly reduces this average time. Rapid chargers are typically located at public short-stay locations or service stations, enabling an EV to achieve a range of 100 miles in just 30 minutes. The specific charging time hinges on both the battery size of the EV and the power output of the charging station.

Charging Time = Battery Size (kWh) / Charging Station Power (kW)

This aspect notably influences individual perceptions, as many still associate gasolines refueling stations with a quick 5-minute fill-up. The comparatively longer charging times at roadside EV charging points can potentially disrupt the convenience factor during longer journeys.

Safety Challenges:

EVs catching fire is a topic that has garnered frequent attention. Operating on rechargeable batteries, EVs inherently face risks related to under or overcharging. There are instances where the software systems responsible for managing charging technology fail to effectively monitor and control the entire battery system, resulting in incidents of overheating or thermal runaways that can lead to fires. This expands safety concerns and fosters consumer mistrust.

Many countries still lack stringent measures and regulations to closely monitor the readiness of charging infrastructure or proper adherence to battery manufacturing protocols. As EVs continue to gain prominence in government agendas, it is anticipated that more rigorous regulations will be introduced to oversee the EV ecosystem and its value chain, enhancing safety and consumer confidence.

Nations Going Emission Free from Vehicles:

Major Initiatives Taken for Electric Vehicles by the Top-5 Economies:

United States:

The United States (US) is ambitiously targeting 50% of all new vehicle sales to be electric by 2030, driven by a remarkable threefold growth in EV sales. The country has also witnessed an over 40% increase in publicly available charging ports since 2021. As of 2023, the US boasts a fleet of over 3 million EVs on its roads, supported by more than 135,000 public EV chargers dispersed across the nation. With a forward-looking vision, the US aims to establish a comprehensive national network of 500,000 EV chargers by 2030.

To propel EV adoption, the US has recently expanded tax credits for both new and used EV purchases, while also offering incentives for electrifying heavy-duty vehicles such as school buses. The nation is actively promoting the installation of residential, commercial, and municipal EV charging infrastructure. These efforts are reinforced by attractive incentives designed to reduce the cost of EVs and their associated charging infrastructure, thereby boosting consumer demand. Notably, the US has allocated USD 100 billion for EV battery manufacturing and initiatives like the EV Acceleration Challenge, with the goal of delivering clean, safe, affordable, and reliable transportation in the future.

In 2023, the US unveiled funding to accelerate the development of zero-emission vehicle corridors, aiming to revitalize its EV charging infrastructure. Through the Department of Energy (DOE), USD 7.4 million was allocated to seven projects intended to advance medium- and heavy-duty EV charging and hydrogen corridor infrastructure plans, catering to drivers across 23 states.

California is taking a pioneering stance by intending to allow the sale of only fully electric and plug-in hybrid vehicles by 2035. This ambitious initiative aligns with the state’s projection to capture over 80% of the national market share for plug-in vehicles by 2032.

China:

China, in alignment with open economies, maintains an open-door policy for foreign investors, imposing no special restrictions within the EV industry. This approach allows global firms to establish wholly foreign-owned enterprises across various stages of the EV supply chain, including batteries and auto parts. Furthermore, foreign companies have the opportunity to engage in joint ventures with Chinese partners, collaborating on manufacturing, technology development, and distribution, and jointly exploring new business prospects. In more advanced scenarios, foreign firms can directly invest in Chinese EV startups, facilitate technology transfers, or extend licensing agreements to facilitate EV production in China.

In June 2023, China unveiled a substantial USD 72.3 billion tax break package spanning over four years for electric vehicles (EVs) and other environmentally friendly vehicles. Notably, EV purchases in 2024 and 2025 are anticipated to be exempt from the purchase tax, amounting to up to USD 4,170 per vehicle. This exemption will subsequently be reduced by half and capped at approximately USD 2,080 per vehicle for purchases in 2026 and 2027.

Previously, the Shanghai municipal government extended its EV subsidy program, enabling consumers to continue receiving rebates of USD 1,482 per car. Similarly, the Zhejiang government introduced cash incentives for current gas-fueled car owners planning to transition to EVs. Additionally, the province plans to provide free public facilities for EVs, aiming for 60% of its car production to be EVs by 2025. Furthermore, the northern province of Shanxi has announced incentives for public EV bus operators, tax breaks for personal EV purchases, and parking discounts.

Japan:

In January 2023, the Japanese government unveiled a strategy to relax regulations concerning the establishment of rapid-charging EV stations, aiming to enhance Japan’s electric vehicle charging network.

Additionally, in March 2023, Japan forged a collaboration with the United States to secure essential minerals like lithium, nickel, cobalt, graphite, and manganese for EV batteries. This effort is geared towards reinforcing the global battery supply chains. Moreover, this partnership grants Japanese automakers access to a USD 7,500 EV tax credit.

Germany:

Germany has set ambitious goals for electric vehicle (EV) adoption, targeting 13 to 15 million EVs on its roads by 2030. By the beginning of 2023, approximately 1 million EVs had already been registered in Germany, accounting for a fraction of the nearly 49 million total cars sold. By April 2023, this number had risen to 1.2 million fully electric vehicles.

To support this EV surge, Germany has been actively expanding its charging infrastructure. As of the first half of 2023, the country boasted around 90,000 public charging points, with an ambitious plan to scale this number to 1 million by 2030. This push has been accompanied by substantial growth in charging capacity, with the charging setup expanding by over 40% from 1.7 gigawatts to 2.5 gigawatts in 2023.

To incentivize the growth of EVs and charging networks, Germany has allocated substantial funds. In the pursuit of a comprehensive EV charging ecosystem, it has earmarked USD 983 million in subsidies, designed to benefit both households and businesses. Moreover, Germany is keen on encouraging electricity self-supply at private residential buildings linked to EV ownership, offering subsidies of up to USD 548 million to support this initiative.

Companies invested in the development of fast-charging infrastructure for commercial vehicles are not left out either. Germany has committed USD 438 million to support such endeavors, recognizing the importance of robust charging networks for commercial cars and trucks.

Recognizing the importance of such investments, Germany had already unveiled a Charging Infrastructure Masterplan in late 2022. This strategic blueprint aims to expedite the expansion of the EV charging network, with the ultimate goal of reaching 1 million charging points by 2030. This comprehensive plan involves an investment of nearly USD 6.9 billion over a three-year span, demonstrating Germany’s dedication to facilitating the widespread adoption of electric vehicles throughout the nation.

India:

The Indian government has set forth a robust plan to transition 30% of vehicles reliant on fossil fuels to electric vehicles (EVs) by the year 2030. This commitment aligns with the Paris Agreement signed by India in 2015, wherein the nation pledged to decrease the emission intensity of its gross domestic product by roughly 35% compared to 2005 levels by the year 2030.

India has enacted progressive measures to stimulate the EV industry. It permits 100% Foreign Direct Investment (FDI) for electric vehicle projects through automatic channels. Furthermore, establishing charging stations no longer necessitates a separate license under the Electricity Act of 2003, a regulation that came into effect as of April 2018.

The government has previously sanctioned Phase-II of the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) Scheme, allotting INR 10,000 Crore (approximately USD 1.2 Billion) over a span of 3 years from April 2019. A substantial 86% of these funds have been dedicated to Demand Incentives, fostering the adoption of various EV types across the country. This phase aims to catalyze demand by supporting the deployment of 7,000 e-Buses, 500,000 e-3 Wheelers, 55,000 e-4 Wheeler Passenger Cars, and 1,000,000 e-2 Wheelers. Currently, there are 256,980 registered electric vehicles operational in India as of March 2023.

Furthermore, the government initiated the Production Linked Incentive Scheme on Advanced Chemistry Cell (ACC) in 2021, earmarking INR 18,100 Crore (around USD 2.2 Billion) over a span of 5 years. This scheme is designed to encourage local manufacturing of advanced chemistry cells, ultimately leading to reduced battery costs and, in turn, cheaper EVs.

The Indian government’s motivation to transition towards EVs is underscored by escalating expenses related to oil imports and the mounting issue of air pollution. An anticipated report suggests that India’s EV market is poised to grow at a Compound Annual Growth Rate (CAGR) of 49% between 2021 and 2030, with projected EV sales surpassing 17 million units by 2030.

Key Developments Happened Around Electric Vehicles in the Top-5 Economies:

United States:

1. Uber is strategically working to achieve a milestone of facilitating 400 million electric vehicle (EV) miles traveled on its platform in the United States by the year 2023. To accomplish this, the company is utilizing resources from its Green Future initiative, establishing partnerships with automakers and charging infrastructure companies, all with the aim of assisting drivers in their transition to EVs.

2. Zipcar, an American car-sharing enterprise, has set a noteworthy goal to dedicate 25% of its electric vehicle fleet to serve disadvantaged communities in the year 2023, underscoring a commitment to equitable access to sustainable transportation options.

3. Redwood Materials, a US-based manufacturer specializing in EV batteries, is embarking on a substantial expansion of its production capabilities for critical battery components within the United States. The primary objective of this endeavor is to bolster the production of components crucial to EV batteries, aiming to contribute to the production of 5 million EVs by the year 2030.

4. Highland Electric Fleets, another US-based company, is focusing on the electrification of vehicle fleets, particularly in the school bus sector. Their ambitious aim is to collaborate with and support 1,000 North American school districts in transitioning their school bus fleets to electric power by the year 2030.

5. Xcel Energy, a prominent utility company in the US, has entered into a partnership with a local car-sharing venture known as Colorado Car. This partnership is geared towards launching an electric car-sharing initiative in Colorado, with the goal of making electric vehicles more accessible and convenient through car-sharing programs. The anticipated launch is set to take place by the conclusion of 2023.

China:

1. China has emerged as a trailblazer in the realm of electric vehicle (EV) adoption. Notably, the Chinese government has observed a 4.9% year-on-year increase in Foreign Direct Investment (FDI) in EVs during the initial quarter of 2023, amassing an impressive total of USD 59.3 billion. Adding to this, a recent report projects that China’s EV market will undergo a CAGR of 6.4% from 2023 to 2028. However, there is an evolving narrative as China’s domestic market appears to be nearing saturation, prompting several leading Chinese EV manufacturers to diversify their operations worldwide. It’s worth highlighting that certain investments within mainland China persist, poised to provide ongoing reinforcement to the local EV ecosystem.

2. Volkswagen, the distinguished German automaker, is strategically allocating approximately USD 1.1 billion in China to drive the development of electric cars, foster innovation, and secure fully connected electric vehicles. Concurrently, China’s EV behemoth, BYD, is directing USD 600 million towards Brazil, seeking to expand its presence in South America. This endeavor emphasizes electric and hybrid vehicles, as well as electric buses and trucks. In another ambitious move, BYD intends to invest USD 1.4 billion in Thailand, positioning itself in competition with predominant local automakers, notably from Japan.

3. Human Horizons, yet another influential player in China’s EV landscape, has entered into a noteworthy partnership with Saudi Arabia, embarking on a substantial USD 5.6 billion undertaking. This collaboration is primarily centered around the development, manufacturing, and sales of EVs.

China’s global engagement doesn’t halt there. Collaborations with European nations and Indonesia have materialized, aiming to expand the EV battery business. This strategic initiative holds the potential to not only bolster EV adoption within China but also contribute to the international proliferation of electric vehicles.

Japan:

1. Japan is poised to significantly enhance its support for EV battery production, with an impressive commitment of up to USD 2.2 billion. In a notable move, a substantial USD 853 million subsidy is earmarked to fortify Toyota Motor’s expansion of electric-vehicle battery production. Toyota’s aspiration in response to this support is to introduce solid-state-battery EVs by the year 2027, marking a significant leap in the realm of electric mobility.

2. Suzuki Motor, a key player in the Japanese automotive landscape, has charted an ambitious path forward. With an extensive investment of USD 34.8 billion allocated for Research and Development (R&D) and broader growth objectives by 2030, Suzuki’s endeavors are poised to include vehicle electrification. This comprehensive approach encompasses the establishment of an EV production facility equipped with renewable energy infrastructure, with a pronounced focus on the advancement of autonomous driving technologies, all set to unfold in 2023.

3. Collaboration among Japan’s prominent automakers, including Suzuki, Daihatsu, and Toyota, has borne fruit in the form of prototypes for mini-commercial EVs. The design expertise of Suzuki and Daihatsu converges with Toyota’s electrification technology prowess to create these prototypes. An expected range of around 200 km per charge highlights the practicality of this joint effort.

4. Meanwhile, Japan-headquartered Honda has set forth a commendable objective: to render its entire model lineup either electric or hydrogen fuel cell-based by the year 2040. This resolute aim is propelled by the intention to achieve complete emission-free mobility by that pivotal juncture.

5. In April 2023, Panasonic orchestrated a noteworthy collaboration with Ubiden, a prominent Japanese EV charging solutions provider. This strategic partnership is poised to extend the reach of EV charging services in Japan, signifying a commitment to bolster the charging infrastructure to complement the growing EV ecosystem.

Germany:

1. In the year 2023, the renowned German automaker, Volkswagen, has unveiled an ambitious strategy encompassing a substantial investment of approximately USD 193 billion spanning from 2023 to 2027. This impressive financial commitment is directed towards a multifaceted approach, encompassing EV software development, the establishment of battery factories, and a range of supplementary investments. What’s noteworthy is that this expansive initiative extends not only within Germany but across the globe, reflecting Volkswagen’s determination to fortify its international standing in the realm of electric vehicles.

2. Stellantis, a Netherlands-based automotive conglomerate, has solidified its intention to invest USD 142 million into an existing assembly plant in Germany. This strategic allocation will facilitate the production of new battery electric vehicles, commencing from the second half of 2023. As part of their corporate roadmap, Stellantis has set forth ambitious targets: they aim for a remarkable 100% of their European passenger car sales and 50% of their US passenger car and light-duty truck sales to be entirely battery-powered by 2030. Brands under the Stellantis umbrella, such as Peugeot, Fiat, Alfa Romeo, and Jeep, are pivotal players in this transformation.

3. In a noteworthy move, Ford has inaugurated a cutting-edge EV center in Germany, marked by a substantial investment of USD 2 billion. This facility holds the distinction of being Ford’s first carbon-neutral assembly plant in Germany. The overarching objective of this endeavor is to propel the sale of 600,000 fully electric cars in Europe by 2026, well in advance of their larger-scale transition to a fully electric lineup by 2035.

4. Furthering the momentum in the EV sector, Northvolt, a prominent EV battery manufacturer hailing from Sweden, has earmarked a considerable sum of USD 8 billion for the establishment of an EV battery cell plant in Germany. This ambitious project, set to unfold in 2023, stands as a testament to Northvolt’s commitment to expanding their manufacturing capabilities, with the aim of contributing to the growth and progress of the electric vehicle industry.

India:

1. The Delhi-Chandigarh highway has achieved a significant milestone by becoming the first Indian national highway to be made e-vehicle friendly. This accomplishment is attributed to the successful installation of 20 solar-based EV chargers by Bharat Heavy Electricals Limited, a state-owned organization. The EV charging infrastructure in India is advancing, with a total of 6,586 fully operational public EV charging stations as of March 2023, including 419 stations operational along national highways.

2. Hyundai Motor is set to make a substantial investment of USD 2.45 billion between 2023 and 2033 in the southern Indian state of Tamil Nadu. This financial commitment is geared towards enhancing Hyundai’s electric vehicle endeavors within India. Plans include the assembly of EV battery packs and the establishment of 100 charging stations for EVs, strategically distributed across the state from 2023 to 2028.

3. Ola Electric, a prominent player in India’s EV landscape, is charting an impressive course with an investment of USD 920 million in Tamil Nadu. This endeavor aims to manufacture electric cars and EV batteries through its subsidiaries, Ola Electric Technologies and Ola Cell Technologies. A notable increase in car manufacturing capacity, from 100,000 units to 140,000 units, is anticipated as a result of this investment, with the addition of 3,111 new workers.

4. India’s largest car manufacturer, Maruti Suzuki, is set on a transformative path. With plans to boost its manufacturing capacity from 2.5 million cars to around 4 million units, the company is poised for significant growth. Moreover, a shift towards electric vehicles is evident, as Maruti Suzuki plans to introduce 6 electric vehicle models by 2031.

Collectively, the Indian automotive industry is set to make a substantial investment of approximately USD 10 billion, aimed at establishing a robust infrastructure for the burgeoning EV ecosystem. This investment strategy prioritizes the establishment of green field plants dedicated to EV production, advancement in battery research and development, and the expansion of grid charging infrastructure. The anticipated outcome of this concerted effort is the creation of a manufacturing capacity capable of producing around 2 million EVs, with the potential to scale up to 7.5 million units by the year 2030.

3 thoughts on “A Comprehensive Look at the Details of Electric Vehicles (EVs) and Their Prospects Ahead”